MARKETS

All of the World’s Wealth in One Visualization

Published

9 months agoon

January 16, 2020

All of the World’s Wealth in One Visualization

The financial concept of wealth is broad, and it can take many forms.

While your wealth is most likely driven by the dollars in your bank account and the value of your stock portfolio and house, wealth also includes a number of smaller things as well, such as the old furniture in your garage or a painting on the wall.

From the macro perspective of a country, wealth is even more all-encompassing — it’s not just about the assets held by private households or businesses, but also those owned by the public. What is the value of a new toll bridge, or an aging nuclear power plant?

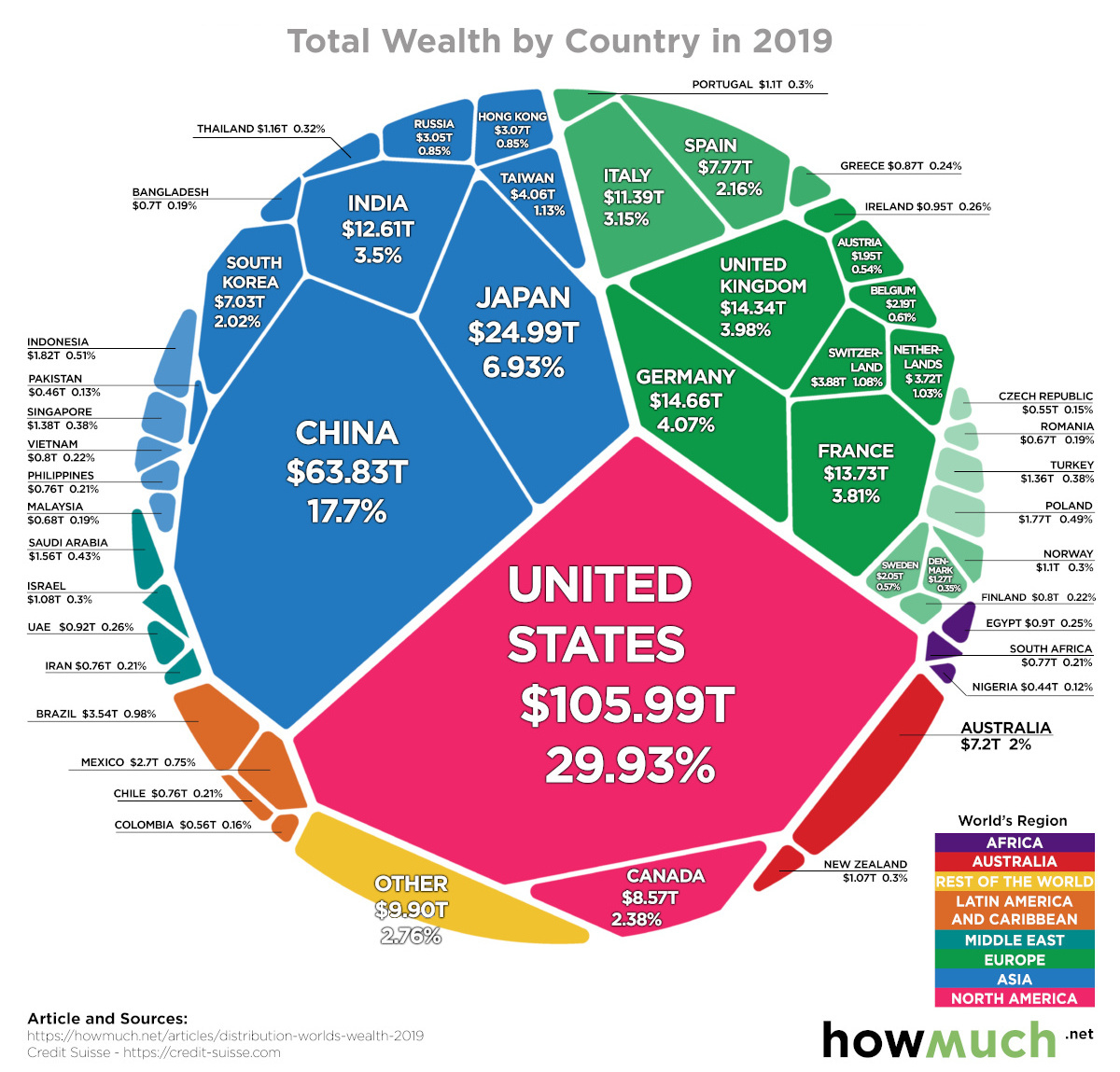

Today’s visualization comes to us from HowMuch.net, and it shows all of the world’s wealth in one place, sorted by country.

Total Wealth by Region

In 2019, total world wealth grew by $9.1 trillion to $360.6 trillion, which amounts to a 2.6% increase over the previous year.

Here’s how that divvies up between major global regions:

| Region | Total Wealth ($B, 2019) | % Global Share |

|---|---|---|

| North America | $114,607 | 31.8% |

| Europe | $90,752 | 25.2% |

| Asia-Pacific | $64,778 | 18.0% |

| China | $63,827 | 17.7% |

| India | $12,614 | 3.5% |

| Latin America | $9,906 | 2.7% |

| Africa | $4,119 | 1.1% |

| World | $360,603 | 100.0% |

Last year, growth in global wealth exceeded that of the population, incrementally increasing wealth per adult to $70,850, a 1.2% bump and an all-time high.

That said, it’s worth mentioning that Credit Suisse, the authors of the Global Wealth Report 2019 and the source of all this data, notes that the 1.2% increase has not been adjusted for inflation.

Ranking Countries by Total Wealth

Which countries are the richest?

Let’s take a look at the 15 countries that hold the most wealth, according to Credit Suisse:

| Rank | Country | Region | Total Wealth ($B, 2019) | % Global Share |

|---|---|---|---|---|

| #1 |  United States United States | North America | $105,990 | 29.4% |

| #2 |  China China | China | $63,827 | 17.7% |

| #3 |  Japan Japan | Asia-Pacific | $24,992 | 6.9% |

| #4 |  Germany Germany | Europe | $14,660 | 4.1% |

| #5 |  United Kingdom United Kingdom | Europe | $14,341 | 4.0% |

| #6 |  France France | Europe | $13,729 | 3.8% |

| #7 |  India India | India | $12,614 | 3.5% |

| #8 |  Italy Italy | Europe | $11,358 | 3.1% |

| #9 |  Canada Canada | North America | $8,573 | 2.4% |

| #10 |  Spain Spain | Europe | $7,772 | 2.2% |

| #11 |  South Korea South Korea | Asia-Pacific | $7,302 | 2.0% |

| #12 |  Australia Australia | Asia-Pacific | $7,202 | 2.0% |

| #13 |  Taiwan Taiwan | Asia-Pacific | $4,062 | 1.1% |

| #14 |  Switzerland Switzerland | Europe | $3,877 | 1.1% |

| #15 |  Netherlands Netherlands | Europe | $3,719 | 1.0% |

| All Other Countries | $56,585 | 15.7% | ||

| Global Total | $360,603 | 100.0% |

The 15 wealthiest nations combine for 84.3% of global wealth.

Leading the pack is the United States, which holds $106.0 trillion of the world’s wealth — equal to a 29.4% share of the global total. Interestingly, the United States economy makes up 23.9% of the size of the world economy in comparison.

Behind the U.S. is China, the only other country with a double-digit share of global wealth, equal to 17.7% of wealth or $63.8 trillion. As the country continues to build out its middle class, one estimate sees Chinese private wealth increasing by 119.5% over the next decade.

Impressively, the combined wealth of the U.S. and China is more than the next 13 countries in aggregate — and almost equal to half of the global wealth total.

YOU MAY LIKE

Mapped: The Countries With the Most Military Spending

3D Map: The U.S. Cities With the Highest Economic Output

Shapes of Recovery: When Will the Global Economy Bounce Back?

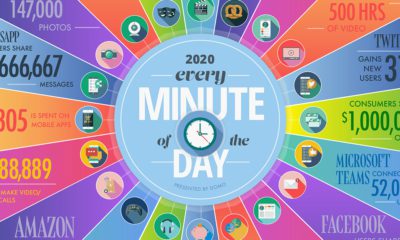

Here’s What Happens Every Minute on the Internet in 2020

The $88 Trillion World Economy in One Chart

Animated Map: The Comparative Might of Continents

MARKETS

The New Rules of Leadership: 5 Forces Shaping Expectations of CEOs

This infographic delves into five major forces reshaping our world and the new rules of leadership that CEOs should follow as a result.

Published

1 week agoon

September 23, 2020

It’s common knowledge that CEOs assume a long list of roles and responsibilities.

But in today’s world, more and more people rely on them to go beyond their day-to-day responsibilities and advocate for broader social change. In fact, a number of external forces are changing how leaders are now expected to behave.

How can leaders juggle these evolving expectations while successfully leading their companies into the future?

The New Rules of Leadership

This infographic from bestselling author Vince Molinaro explores five drivers reshaping our world that leaders must pay attention to in order to bring about real change.

How is the World Being Reshaped?

Leaders need to constantly stay one step ahead of the transformative forces that impact businesses on a broader scale.

Below we outline five key drivers that are changing what it means to be a leader in today’s world:

1. Transformative Technologies

Over the last number of decades, several technologies have emerged that could either accelerate the disruption of companies, or provide them with new opportunities for growth. According to KPMG, 72% of CEOs believe the next three years will be more critical for their industry than the previous 50 years.

For example, artificial intelligence (AI), can now provide companies with insights into what motivates their employees and how they can help them succeed. IBM’s AI predictive attrition program can even predict when employees are about to quit—saving them roughly $300 million in retention costs.

Leaders must accept that the future will be mediated by technology, and how they respond could determine whether or not their organization survives entirely.

2. Geopolitical Instability

Geopolitical risks—such as trade disputes or civil unrest—can have a catastrophic impact on a business’s bottom line, no matter its industry. Although 52% of CEOs believe the geopolitical landscape is having a significant impact on their companies, only a small portion say they have taken active steps to address these risks.

By being more sensitive to the world around them, leaders can anticipate and potentially mitigate these risks. Extensive research into geopolitical trends and leveraging the appropriate experts could support a geopolitical risk strategy, and alleviate some of the potential repercussions.

3. Revolutionizing the Working Environment

As the future of work looms, leaders are being presented with the opportunity to reimagine the inner workings of their company. But right now, they are fighting against a wide spectrum of predictions around what they should expect, with estimations surrounding the automation risk of jobs ranging from 5% to 61% as a prime example.

While physical, repetitive, or basic cognitive tasks carry a higher risk of automation, the critical work that remains will require human interaction, creativity, and judgment.

Leaders should avoid getting caught up in the hype regarding the future of work, and simply focus on helping their employees navigate the next decade.

By creating an inspiring work environment and investing in retraining and reskilling, leaders can nurture employee well-being and create a sense of connectedness and resilience in the workplace.

4. Delivering Diversity

Diversity and inclusion can serve as a path to engaging employees, and leaders are being asked to step up and deliver like never before. A staggering 77% of people feel that CEOs are responsible for leading change on important social issues like racial inequality.

But while delivering diversity, equity, and inclusion seems to be growing in importance, many companies are struggling to understand the weight of this issue.

An example of this is Noah’s Ark Paradox, which describes the belief that hiring “two of every kind” creates a diverse work environment. In reality, this creates a false sense of inclusion because the voices of these people may never actually be heard.

Modern day leaders must create a place of belonging where everyone—regardless of gender, race, sexual orientation, ability, or age—is listened to.

5. Repurposing Corporations

The drivers listed above ladder up to the fact that society is looking to businesses to help solve important issues, and leaders are the ones being held accountable.

With 84% of people expecting CEOs to inform conversations and policy debates on one or more pressing issues, from job automation to the impact of globalization, CEOs have the potential to transform their organization by galvanizing employees on the topics that matter to them.

For a long time, the purpose of corporations was purely to create value for shareholders. Now, leaders are obligated to follow a set of five commitments:

- Deliver value to customers

- Invest in employees

- Deal fairly and ethically with suppliers

- Support communities

- Generate long-term value for shareholders

Ultimately, these five commitments build currency for trust, which is critical for sustained growth and building a productive and satisfied workforce.

Lead the Future

If leaders understand the context they operate in, they can identify opportunities that could fuel their organization’s growth, or alternatively, help them pivot in the face of impending threats.

But organizations must invest in the development of their leaders so that they can see the bigger picture—and many are failing to do so.

By recognizing the new rules of leadership, CEOs and managers can successfully lead their organizations, and the world, into a new and uncertain future.

MARKETS

3D Map: The U.S. Cities With the Highest Economic Output

The total U.S. GDP stands at a whopping $21 trillion, but which metro areas contribute to the most in terms of economic output?

Published

1 week agoon

September 22, 2020

3D Map: The U.S. Cities With the Highest Economic Output

At over $21 trillion, the U.S. holds the title of the world’s largest economy—accounting for almost a quarter of the global GDP total. However, the fact is that a few select cities are responsible for a large share of the country’s total economic output.

This unique 3D map from HowMuch puts into perspective the city corridors which contribute the most to the American economy at large.

Top 10 Metros by Economic Output

The visualization pulls the latest data from the U.S. Bureau of Economic Analysis (BEA, 2018), and ranks the top 10 metro area economies in the country.

One thing is immediately clear—the New York metro area dwarfs all other metro area by a large margin. This cluster, which includes Newark and Jersey City, is bigger than the metro areas surrounding Los Angeles and Chicago combined.

| Rank | Metro Area | State codes | GDP (2018) |

|---|---|---|---|

| #1 | New York-Newark-Jersey City | NY-NJ-PA | $1.77T |

| #2 | Los Angeles-Long Beach-Anaheim | CA | $1.05T |

| #3 | Chicago-Naperville-Elgin | IL-IN-WI | $0.69T |

| #4 | San Francisco-Oakland-Berkeley | CA | $0.55T |

| #5 | Washington-Arlington-Alexandria | DC-VA-MD-WV | $0.54T |

| #6 | Dallas-Fort Worth-Arlington | TX | $0.51T |

| #7 | Houston-The Woodlands-Sugar Land | TX | $0.48T |

| #8 | Boston-Cambridge-Newton | MA-NH | $0.46T |

| #9 | Philadelphia-Camden-Wilmington | PA-NJ-DE-MD | $0.44T |

| #10 | Atlanta-Sandy Springs-Alpharetta | GA | $0.40T |

| Total GDP | $6.90T |

Coming in fourth place is San Francisco on the West Coast, with $549 billion in total economic output each year. Meanwhile in the South, the Dallas metroplex brings in $478 billion, placing it sixth in the ranks.

It’s worth noting that using individual metro areas is one way to view things, but geographers also think of urban life in broader terms as well. Given the proximity of cities in the Northeast, places like Boston, NYC, and Washington, D.C. are sometimes grouped into a single megaregion. When viewed this way, the corridor is actually the world’s largest in economic terms.

U.S. States: Sum of Its Parts

Zooming out beyond just these massive cities demonstrates the combined might of the U.S. in another unique way. Tallying all the urban and rural areas, every state economy can be compared to the size of entire countries.

According to the American Enterprise Institute, the state of California brings in a GDP that rivals the United Kingdom in its entirety.

By this same measure, Texas competes with Canada in terms of pure economic output, despite a total land area that’s 15 times less that of the Great White North.

With COVID-19 continuing to impact parts of the global economy disproportionately, how will these kinds of economic comparisons hold up in the future?

POPULAR

TECHNOLOGY2 months ago

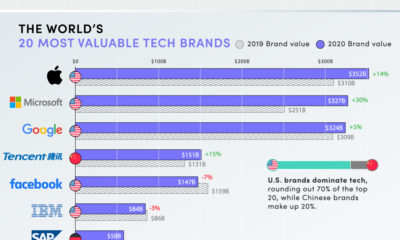

TECHNOLOGY2 months agoThe World’s Tech Giants, Ranked by Brand Value

TECHNOLOGY2 months ago

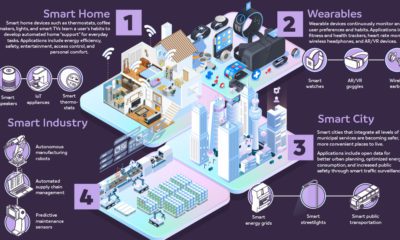

TECHNOLOGY2 months agoAIoT: When Artificial Intelligence Meets the Internet of Things

TECHNOLOGY1 month ago

TECHNOLOGY1 month agoVisualizing the Social Media Universe in 2020

TECHNOLOGY2 weeks ago

TECHNOLOGY2 weeks agoHere’s What Happens Every Minute on the Internet in 2020

TECHNOLOGY1 month ago

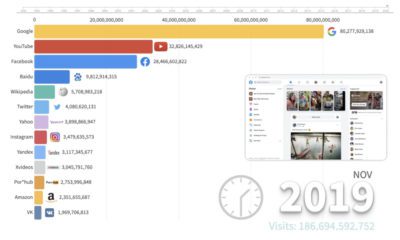

TECHNOLOGY1 month agoRanked: The Most Popular Websites Since 1993

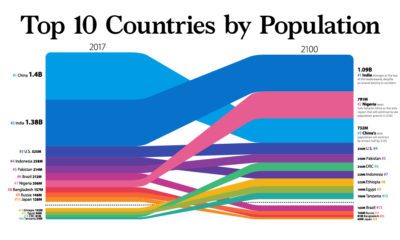

DEMOGRAPHICS4 weeks ago

DEMOGRAPHICS4 weeks agoThe World Population in 2100, by Country

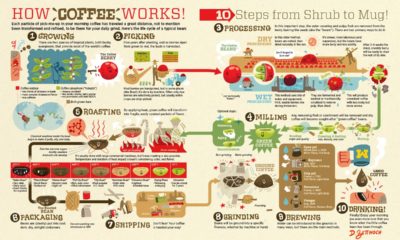

BUSINESS2 months ago

BUSINESS2 months agoFrom Bean to Brew: The Coffee Supply Chain

MARKETS2 months ago

MARKETS2 months agoThe 20 Most and Least Profitable Companies, Per Employee

No comments:

Post a Comment