JPMorgan and the Prophecy of the Next Financial Crisis

JPM championed two financial innovations that led to global financial crises. Will there be a third with crypto and JPM Coin?

Among Chinese gamblers in casinos there is a saying, one way to gamble is to find someone who is down on his luck and always losing. Just bet the opposite of what he does. He is the ‘lamp’ who will light your way to winnings.

Well, there is one investment bank which tends to support new financial innovations right before it fuels a crisis. That bank is JPMorgan (JPM).

The last two times it happened was in 1998 and 2008. By JPM’s own reckoning the next financial crisis could be in 2020. This has been predicted and publicized by their own elite strategists using economics modelling.

They are not entirely sure what could cause it, but looking at the firm’s history I am going to stick my neck out and say it could be due to cryptocurrencies.

Why?

Let’s go through the history lessons quickly first…

Calling yourself ‘long-term’ doesn’t mean you’ll last…

In August 1998, the Russian government announced it was devaluing their currency and defaulting on their government bonds. The financial market panic that followed led to the collapse of a giant hedge fund called ‘Long-Term Capital Management’ (LTCM), which had about US$125 billion in assets.

In the following month the US Federal Reserve had to organize a private bailout of LTCM, because the fund had become so big and so entangled with various banks and financial institutions its collapse would have triggered a major financial crisis.

LTCM had only about US$4.7 billion in capital at that point in time, but through massive borrowing and leveraging, it was able to own assets some 26 timesits equity base. What was even more scary, was that its combined trading position in various markets and instruments, reportedly amounted to over US$1.45 trillion dollars in exposure.

At the time of rescue, the fund reportedly had 60,000 trades on its books. The balance sheet consisted of over $50 billion of long positions and short positions of an equivalent magnitude; total futures positions of over $500 billion; over-the-counter (‘OTC’) swaps positions of over $750 billion, as well as, options and other OTC derivatives with a notional value of over $150 billion. The Fed intervened because it was concerned about the possibly dire consequences for world financial markets if it allowed the hedge fund to fail.— “Examination of VaR After Long Term Capital Management”, Hakan Yalincak, Yu Li and Mike Tong, New York University, Risk Management In Financial Institutions (Spring 2005)

How did one single hedge fund manage to build an asset base and financial exposure that rivaled all but some of the biggest countries in the world?

Of swans and bubbles

LTCM was founded by luminaries from investment banks and the academic world of financial mathematics. Their sheer credibility led to few questioning their methods for risk management.

The method they used is call ‘Value at Risk’ (VaR). It is essentially a mathematical model that predicts the likelihood of various price movements for an asset within a certain period of time.

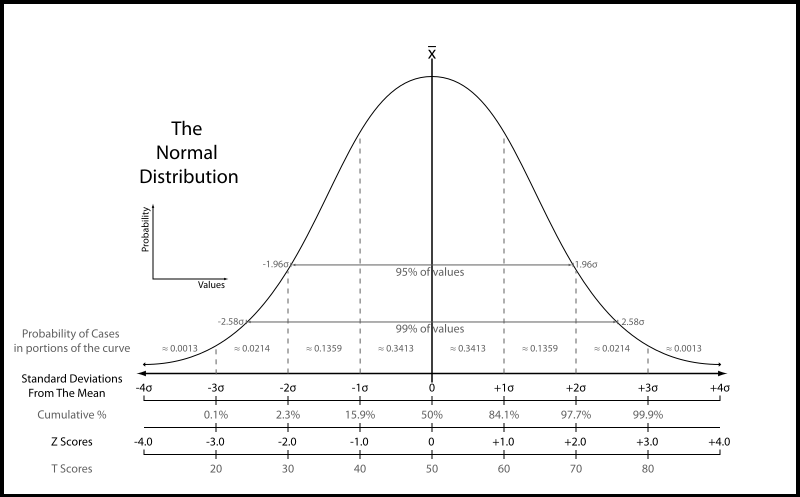

The statistical concept underlying VaR assumes that price movements in the real world could be approximated by what is called a ‘normal distribution’. This theory says that the distribution of possible values for any given event tends to cluster around the average to form a bell shape line once there were a large enough number of outcomes.

Therefore, for any given period of time, the range of price movements and their probability for any financial instrument could be modeled based on historical data or random number simulations.

From this sort of mathematical modelling an investment fund could compute their overall risk exposure across the various financial instruments and asset classes they had taken a position in and arrive at a statement that said, for example, that they had a 1% chance of losing ‘X’ amount over the next 10 days.

The general idea was, if the entity in question maintained enough capital to cover the majority of loss scenarios, then given a diversified enough portfolio, rare and big price fluctuations couldn’t all happen all at once and wipe out the portfolio immediately.

The world is always wiser only in hindsight, and there have been many critics of this method ever since the LTCM crisis. The most famous is Nassim Taleb, whose bestselling book ‘The Black Swan’, looked at how methods like VaR are flawed in trying to predict and manage the impact from rare events.

In the specific case of LTCM, the most striking accusation was the fact that the fund claimed to have the same overall risk exposure as the historical volatility of the S&P 500 index. However, the way LTCM arrived at this conclusion was by allegedly using only the last 500 days of historical data, conveniently leaving out abnormally wide price swings during the last two crises in 1987 and 1994.

Interested readers can google more about the limitations of VaR and read the NYU paper quoted above to understand how LTCM misused it, but for now our story shall remain focused on JPM’s pivotal role in championing financial innovations that would go on to cause crises.

JPMorgan, VaR and RiskMetrics

The VaR method grew to prominence and acceptance as the industry standard for risk management in the 90’s. Although the theoretical underpinnings were first proposed by academics long ago, the key advocate and leader of the modern VaR methodology was JPM.

Risk management in the 80’s and 90’s was a primitive field and JPM was already actively using VaRlong before market regulators figured out a way to standardize risk management for financial institutions.

How JPM became its leading advocate traces back to 1993, when Paul Volcker, former Chairman of the US Federal Reserve, asked the then Chairman of JPM, Dennis Weatherstone, to lead a study of derivatives trading. The report, which involved many of JPM’s senior executives, recommended the use of VaR as an appropriate method for managing trading risks.

VaR quickly became the industry standard. JPM branded its own version of VaR as a methodology called RiskMetrics. It begun to advocate VaR and provide consulting services to other financial institutions under this brand name. RiskMetrics grew so big it was spun out as a separate company in 1998 (right after LTCM imploded…).

The RiskMetrics Group was sold to MSCI Inc in 2010 for US$1.55 billion.

No income? That’s great, here’s a house

“The crisis was the worst U.S. economic disaster since the Great Depression. In the United States, the stock market plummeted, wiping out nearly $8 trillion in value between late 2007 and 2009. Unemployment climbed, peaking at 10 percent in October 2009. Americans lost $9.8 trillion in wealth as their home values plummeted and their retirement accounts vaporized.”— “A guide to the financial crisis — 10 years later”, The Washington Post, September 10, 2018

The credit crisis begun in 2007. Real estate markets across the US had started falling as a housing bubble begun to deflate. The bubble was due to the proliferation of ‘sub-prime loans’ in the years before.

Sub-prime loans were basically home mortgages given out to buyers who had bad credit records or no income. When such borrowers became unable to service their mortgage, the banks seized their property and put them on fire sales to recover what value they can.

This led to downward pressures on home prices which became a vicious cycle in the economy, causing many borrowers to fall into a ‘negative equity’ trap. Such a situation occurs when your property’s market value falls below what the bank loaned you. In such cases if you are unable to service your loan and the bank forecloses on you, you end up homeless and in debt! (Since they sold your property for less than what you owed them for the mortgage.)

But how did mortgage lenders believe that it was a good idea to lend money to borrowers who had a high chance of not being able to service their mortgages?

This all traces back, once again, to a financial innovation that JPM championed.

The ‘magic’ of large numbers and small probabilities… yet again

In 1997, a particularly bright woman by the name of Blythe Masters created a ‘broad index secured trust offering’, or ‘Bistro’, in short. It was an investment structure that combined an off balance sheet investment vehicle with credit derivatives, which made it possible to “remove risk from companies’ balance sheets”.

Masters was working for JPM then. Her exceptional performance made her the CFO of the bank at the record breaking age of 34. The Bistro structure she created became very successful. JPM did it many times, made a lot of money, and also started selling the know-how to other financial institutions so that they could create similar structures of their own.

Fast forward to September 2008. The credit crisis was peaking. According to an article written by The Guardian at the height of the crisis, “Many of the highly qualified mathematicians and academics who worked on the credit derivatives market in the early days have gone on to run hedge funds and into high-powered jobs at other investment banks, but most of them started out at JPMorgan.”

Masters was part of this elite group of sharp minds at JPM who created the complex credit derivatives that fueled the credit crisis. Like VaR, they did not pioneer the early mathematical concepts underpinning the derivatives, but they certainly brought it mainstream.

The basic concept behind Bistro and the other credit derivatives structures was that, if you mixed enough different types of debt instruments together — with various credit ratings, maturities, classes and seniority levels etc. — the collective basket becomes diversified enough to have very little chance of suffering significant losses even when some borrowers default. That, plus adding in a layer of insurance from a third party willing to underwrite the default risk of the loan basket, made the structure almost risk free (in mathematical theory at least).

The problem once again boiled down to human greed and abuse. The rising popularity of such credit derivatives structures started encouraging mortgage lenders to believe that, if they gave out enough loans to sub-prime borrowers, and then repackaged them into structures like Bistro, it was almost a risk free business. Since credit derivatives were traded ‘over-the-counter’ and unregulated, it was a free for all…

Unfortunately clever mathematics and structures cannot overcome the fact that markets do not behave in predictable manners once a crisis hits. Panic selling or illiquid markets can break down any sort of theoretical risk management. Once the property downturn became a vicious cycle, defaults rose so quickly that even the cleverest structures begun failing.

By September 2008, some of the biggest names in finance like Lehman Brothers and AIG started going bankrupt from credit derivatives losses and had to be rescued by the US government to stem the global financial chaos.

The only financial institution that made a profit during the crisis

So where was JPM before, during and after this crisis?

As early as October 2006, Jamie Dimon, then and still currently the CEO of JPM, saw the dangers of the whole credit derivatives market they were responsible for creating and ordered a sell down of their positions.

While this resulted in a lower share price performance compared to its peers at the height of the sub-prime boom, the firm also suffered one of the smallest losses in Wall Street when the bubble did burst.

And by Dimon’s own admission, JPM became one of the survivor banks that the government turned to for help. It bought investment bank Bear Stearns and retail bank Washington Mutual in 2008, two giants that went belly up during the credit crisis.

In mid-2009, the media reportedthat JPM was “the only large financial institution that posted a profit during the financial crisis”.

Ironically the acquisition of these two banks landed JPM in a government fault-finding lawsuit after the crisis that eventually resulted in a hefty US$13 billion settlement in 2013. On the flip side it gave JPM an opportunity to dramatically expand its footprint in the financial world at bargain prices.

Ten years later, despite the US$13 billion fine, JPM is now twice as large as it was before the credit crisis and as of September 2018, the largest bank in the world by market capitalization.

And yes, credit derivatives are still around and JPM is still a leading player.

JPM Coin…three times ‘lucky’?

In February 2019, JPM announcedthat it was creating a digital coin call JPM Coin to facilitate “instantaneous transfers of payments between institutional accounts”.

But unlike cryptocurrencies where values are determined by market forces, each JPM Coin will have a fixed value of one US dollar. The value of the JPM coins are backed by actual US dollars in designated accounts within JPM and instantly converted back into paper money upon being received. The sole reason why a digital coin had to be part of the process was to utilize blockchain technology for the transfer. JPM Coin is currently only in the prototype stage, pending regulatory approval.

Dimon had always been a vocal critic of bitcoin as an investment asset and transaction currency. However, the bank he leads clearly sees value in the underlying computational innovation that powers bitcoin and enabled the creation of all the other cryptocurrencies — blockchain.

Dimon himself reportedly said, “Blockchain is real…It’s a technology.”

Call it fate. Bitcoin was first revealed to the world during the height of the credit crisis in 2008. The fact that JPM is the first major US bank to create a digital coin today is eerily striking given the firm’s past with championing groundbreaking financial innovations and the subsequent crises tied to them.

It must be said though, that in the above two historical events, a lot of the underlying factors causing the crises involved human greed and abuse of the methodologies. These were not directly related to JPM itself. When the champagne was flowing, many bankers and fund managers were happy to ignore the cracks that begun to appear.

But if history is anything to go by, the creation of JPM Coin could signal that blockchain and cryptocurrencies will go mainstream and prosper, but not before it fuels a major financial crisis of some sort down the road.

Disclosure: JPM gave me my first job when I graduated from university in 2001. I was an analyst for the forex and fixed income trading desks. This article bears no malice towards my former employer. It is, quite simply, a story grounded in history, which I’ve been wanting to tell for some time…

WRITTEN BY

I write about business, technology and society... Investor | Entrepreneur | Thinker 🔗 https://www.linkedin.com/in/lancengym/

More From Medium

To make Medium work, we log user data. By using Medium, you agree to ourPrivacy Policy, including cookie policy.

No comments:

Post a Comment