Global Wealth Report 2019

- The Credit Suisse Group, a Switzerland-based multinational investment bank, has released the 10th edition of its annual Global Wealth Report.

Global Wealth Report 2019

- The report typically tracks both the growth and distribution of wealth – in terms of the numbers of millionaires and billionaires.

- It tracks the proportion of wealth that they hold – as well as the status of inequality around the world.

How is wealth defined?

- Wealth is defined in terms of “net worth” of an individual.

- This, in turn, is calculated by adding up the value of financial assets (such as money) and real assets (such as houses) and then subtracting any debts an individual may have.

What are the drivers of the wealth of nations?

1) Size of the population

- Several factors can explain why wealth per adult follows a different path in different countries.

- For instance, the overall size of the population is one possible factor that drives wealth per adult in the country. For a country with a huge population, in terms of final calculation, this factor reduces the wealth per adult.

- But there is a flip side as well. A big population also provides a huge domestic market and this creates more opportunities for economic growth and wealth creation.

2) Saving behaviour

- Another important factor is the country’s saving behaviour. A higher savings rate translates into higher wealth. The two variables share a strong positive relationship.

- Overall, a percentage point rise in the savings rate raises the growth rate of wealth per adult by 0.13% each year on average.

- Thus, for example, household wealth in Poland (with an 18% savings rate) would be expected to be 27% higher in mid-2019 if it had matched the savings rate of Sweden (28%),” states the Credit Suisse report.

3) Level of economic activity

- But by far the most important factor in determining the different trends in household wealth among countries is the general level of economic activity as represented by aggregate income, aggregate consumption or GDP.

- That’s because the expansion of economic activity increases savings and investment by households and businesses, and raises the value of household-owned assets, both financial and non-financial.

- But wealth and GDP do not always move in tandem, cautions the report. This is especially so when asset prices fluctuate markedly as they did during the financial crisis.

Key findings of the report

- A key finding of 2019’s report is that China has overtaken the US this year to become “the country with most people in the top 10% of global wealth distribution.

- As things stand, just 47 million people – accounting for merely 0.9% of the world’s adult population – owned $158.3 trillion, which is almost 44% of the world’s total wealth.

- At the other end of the spectrum are 2.88 billion people – accounting for almost 57% of the world’s adult population – who owned just $6.3 trillion or 1.8% of the world’s wealth.

- The other way to look at this distribution of wealth is from the prism of inequality.

- The bottom half of wealth holders collectively accounted for less than 1% of total global wealth in mid-2019, while the richest 10% own 82% of global wealth and the top 1% alone own 45%,” states the report.

Indian case

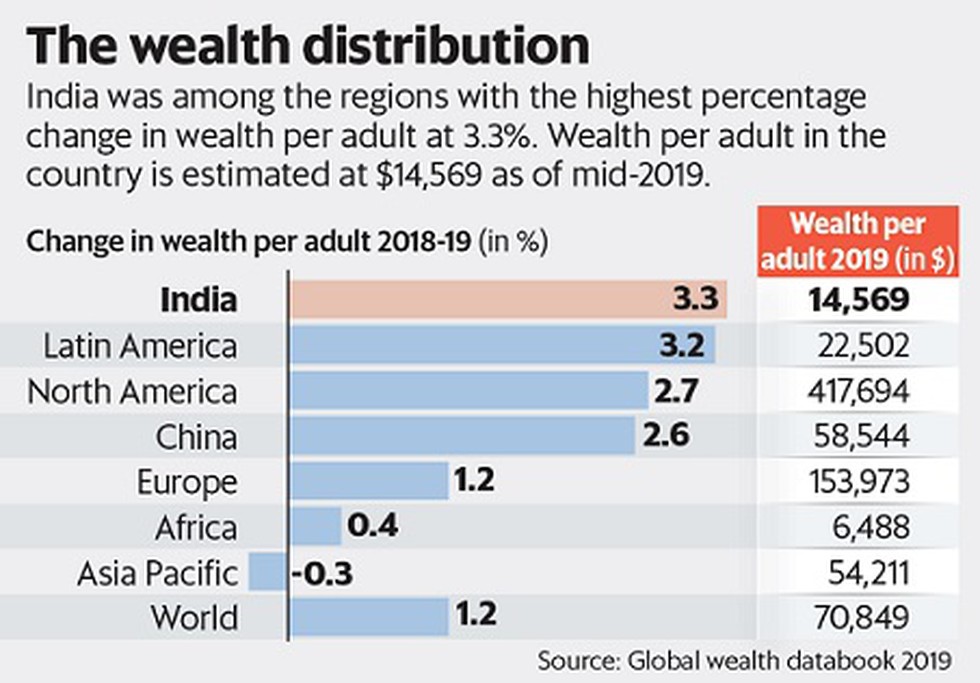

- Total wealth in India increased fourfold between 2000 and 2019, reaching $12.6 trillion in 2019, making India the fifth globally in terms of the number of ultra-high net-worth individuals, as per the report.

- India has 8.27 lakh adults in the top 1% of global wealth holders – 1.6% share of the global pool .

- It is estimated that India has 4,460 adults with wealth of over $50 million and 1,790 that have more than $100 million.

- However, the study also found that while the number of wealthy people in India has been on the rise, a larger section of the population has still not been part of the growth in overall wealth.

Inequality persists

- While wealth has been rising in India, not everyone has shared in this growth.

- There is still considerable wealth poverty, reflected in the fact that 78% of the adult population has wealth below $10,000,” stated the report.

- While highlighting the fact that a small fraction of the population — 1.8% of adults — has a net worth of more than $100,000.

- Meanwhile, as per the financial major, India is expected to grow its wealth very rapidly and add $4.4 trillion in just five years, reflecting an increase of 43%.

No comments:

Post a Comment