Global HNWI wealth hits $60 trillion among 15.4 million people

The wealth of the world’s wealthiest people, those with more than $1 million in non-primary residence based assets, continues its momentous rise. It stood at $59.7 trillion last year, up from $37.2 trillion in 2006. Particularly Asia is seeing a rise in the number of rich: Asia totals more than 5.1 million millionaires, up from 3.3 million in 2010 – globally there are now more than 15.4 million millionaires.

In Capgemini’s latest ‘World Wealth Report’, the 20th edition, the consultancy surveyed 5,200 high-net-worth-individuals (HNWI) across 23 countries as well as desk research, to develop a comprehensive snapshot of the global wealth of the world’s wealthiest people. For the analysis the firm divided HNWls into three distinct wealth bands: Millionaires Next Door (MND), those with $1 million to $5 million in investable wealth; Mid-tier Millionaire, those with $5 million to $30 million; and ultra-HNWl (UHNWI), those with $30 million or more.

Multi-millionaire growthThe number of HNWI across the globe increase slightly to 15.4 million, an average 4.9% increase on last year - growth has slowed somewhat compared to the average rate of 7.7% between 2010 and 2014.

The largest gain (9.4%) in numbers was in the Asia-Pacific region, where 400,000 new rich arrived on the scene bringing the region’s total up to 5.1 million of HNWI. In North America, the number of rich grew by 2%, falling behind the Asian-Pacific region millionaire numbers to reach 4.8 million of HNWI. Two regions saw a decrease in the number of millionaires, Africa, down -1.8%, and Latin America, down -2.2%. Europe saw an increase of 4.8% in 2015, taking the number of HNWI over the 4 million threshold.

The total wealth owned by the richest people on earth has been growing steadily over the past decade. In 2006 HNWI held $37.2 trillion globally, of which $10.1 trillion was held in Europe and $11.2 trillion in North America – Asia at the time, held $8.4 trillion of total wealth. By 2015 the total global wealth has reached $59.7 trillion, a 57.5% increase in less than a decade. The rapid growth in Asia-Pacific economies is reflected in the increased wealth of its richest people, which in 2015 stood at $17.4 trillion.

The coming ten years will continue to see expansion in the total wealth of the world’s wealthiest. The projection from Capgemini for the total HNWI wealth comes in at $108 trillion, a substantial 90.7% growth on last year. Asia-Pacific will continue to dominate, with total wealth in the region increases to $42.1 trillion. North America will see a modest increase, with total wealth in the region reaching $25.7 trillion. Latin America is after Europe the region with the slowest projected growth, up 58.4%.

Given the projections are based on historic trends, and considerable changes are currently taking place globally, there are no guarantees regarding the long term trends. Political and economic headwinds could plunge the region into the so-called middle-income trap, in which a country’s growth allows it to reach middle-income levels but then slows, making the transition to high-income levels seemingly unattainable. Even with a more conservative model, of just 7.0% CAGR in Asia-Pacific (compared to the 9.2% used previously), the total increase in the region would still see it reach $34 trillion by 2025, with global HNWI wealth at $98 trillion.

The research also highlights that the different segments, from the rich to the very rich, have been growing at different rates. While the population growth rate within each segment was relatively close between 2010 and 2014, at around 7.7%, between 2014 and 2015 growth dropped off slightly to 4.9% for MND and 4.2% for UHNWI. In terms of total wealth accretion, MND managed to increase their wealth by an average of 7.7% between 2010 and 2014, while UHNWI managed 6.1% in the same period. Between 2014 and 2015 growth of UHNWI wealth stalled to 2.5% growth. In total UHNWI hold 34.1% of total HNWI wealth, while MND hold 43.1%.

Overseas investedThe wealth of the wealthiest, according to Capgemini’s research, is, in part, not held within the borders of the home country of its owners. Particularly Asian-Pacific nation HNWIs (67.8%) are holding some of their assets abroad. Those in Latin America too are keen on holding cross-border assets, at 60.3%, followed by the Middle East & Africa, at 59.6%. The Japanese are the least likely to own overseas assets, at 46.2%, followed by Europeans, at 49.7%.

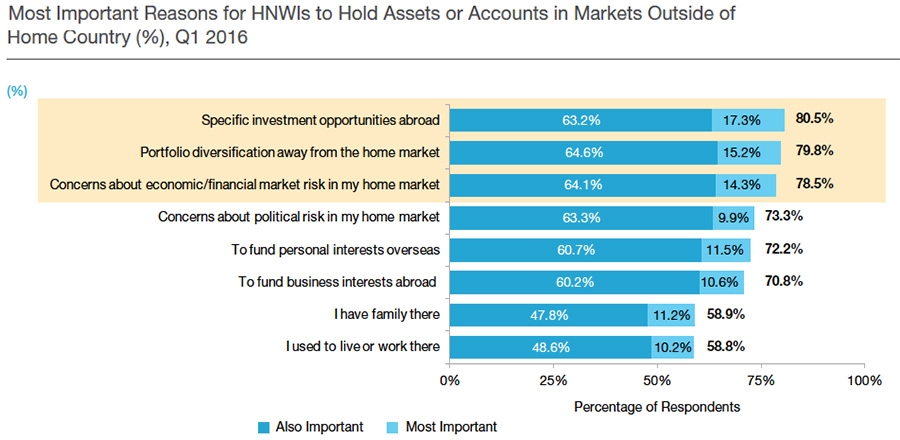

The research also sought to find out why HNWI are diverting wealth away from their home territories. The ‘most important’ to ‘also important’ reasons vary, although the top reason for both was to pursue ‘specific investment opportunities abroad’, cited by 17.3% as the most important reason and by 63.2% as also important. ‘Portfolio diversification away from the home market’ came second, as cited by 79.8% of respondents, with 15.2% citing it as the main reason to move. ‘Concerns about economic/financial market risk in my home market’ was cited by 14.3% as their primary reason, while 64.1% cited it as also a reason.

Funding personal interest overseas was cited as the most important factor by 11.5% of respondents, while ‘I have family there’ was cited as important by 11.2% of respondents. Demographically, 83.9% of HNWls in Asia-Pacific cited specific investment opportunity abroad and 86.5% of HNWI in Latin America cited concern about economic risks in their home markets as an important reason to invest outside their home country.

Digital disconnectTwo other recent reports from consultancies into the wealth management industry, conducted by PwC and EY respectively, found that the demand for digital channels is growing among HNWIs, however, at the same time wealth managers tend to overestimate their digital capabilities, which in turn leads to a disconnect with clients.

No comments:

Post a Comment