MONEY

Ranked: The World’s Richest Families in 2020

Published

2 months agoon

September 3, 2020By

Carmen Ang

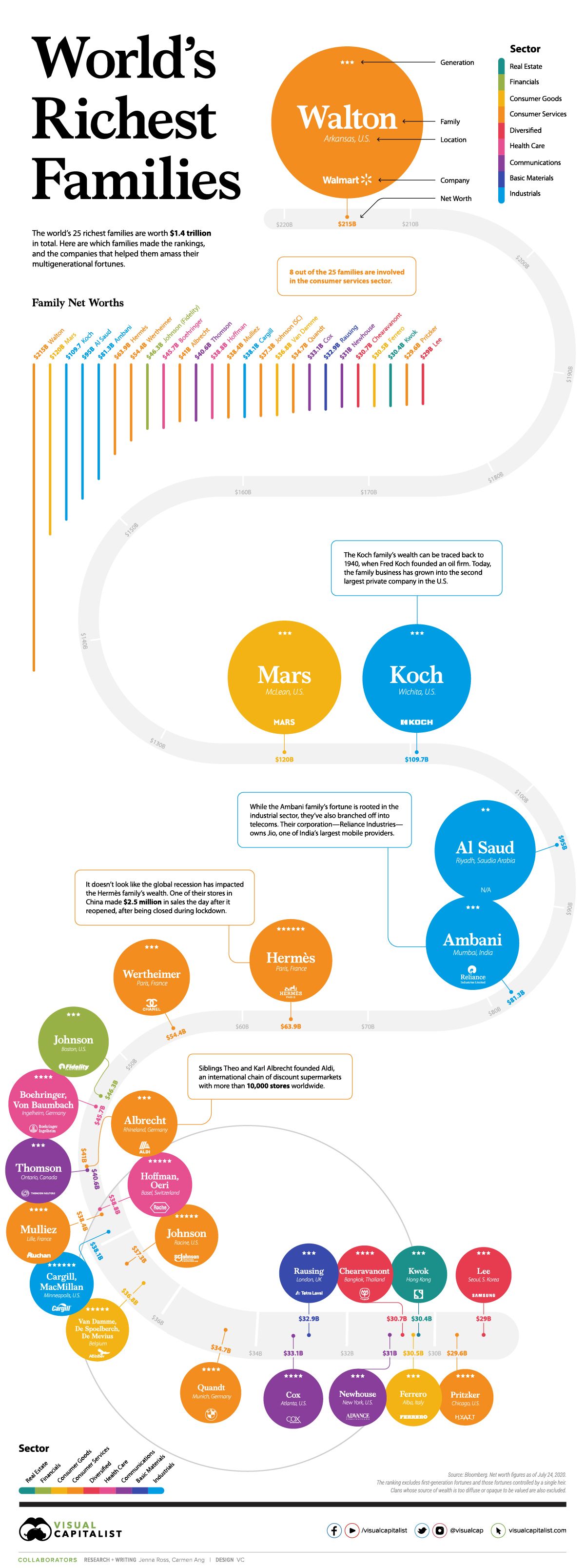

The World’s Richest Families in 2020

The COVID-19 pandemic hasn’t stopped the world’s wealthiest families from growing their fortunes. Over the past year, the richest family—the Waltons—grew their wealth by $25 billion, or almost $3 million per hour.

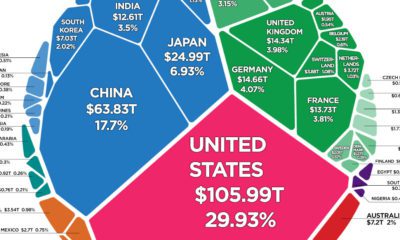

This graphic, using data from Bloomberg, ranks the 25 most wealthy families in the world. The data excludes first-generation wealth and wealth controlled by a single heir, which is why you don’t see Jeff Bezos or Bill Gates on the list. Families whose source of wealth is too diffused or opaque to be valued are also excluded.

The Full Breakdown

Intergenerational wealth is a powerful thing. It often prevails through market crashes, social turmoil, and economic uncertainty, and this year has been no exception.

Here’s a look at the 25 most wealthy families in 2020:

| Rank | Name | Company | Wealth, $B | Sector | Location |

|---|---|---|---|---|---|

| 1 | Walton | Walmart | 215 | Consumer services |  Bentonville, Arkansas Bentonville, Arkansas |

| 2 | Mars | Mars | 120 | Consumer goods |  McLean, Virginia McLean, Virginia |

| 3 | Koch | Koch Industries | 109.7 | Industrials |  Wichita, Kansas Wichita, Kansas |

| 4 | Al Saud | N/A | 95 | Industrials |  Riyadh, Saudi Arabia Riyadh, Saudi Arabia |

| 5 | Ambani | Reliance Industries | 81.3 | Industrials |  Mumbai, India Mumbai, India |

| 6 | Hermès | Hermès | 63.9 | Consumer services |  Paris, France Paris, France |

| 7 | Wertheimer | Chanel | 54.4 | Consumer services |  Paris, France Paris, France |

| 8 | Johnson (Fidelity) | Fidelity Investments | 46.3 | Financials |  Boston, New York Boston, New York |

| 9 | Boehringer, Von Baumbach | Boehringer Ingelheim | 45.7 | Health care |  Inglheim, Germany Inglheim, Germany |

| 10 | Albrecht | Aldi | 41 | Consumer services |  Rhineland, Germany Rhineland, Germany |

*Note: The Al Saud’s net worth is based on cumulative payouts royal family members were estimated to have received over the past 50 years.

The Waltons are the richest family on the list by far, with a net worth of $215 billion—that’s $95 billion more than the second wealthiest family. Sam Walton, the family’s patriarch, founded Walmart in 1962. Since then, it’s become the world’s largest retailer by revenue.

When Sam passed away in 1992, his three children—James, Alice, and Rob—inherited his fortune. Now, the trio co-owns about half of Walmart.

In second place is the Mars family, with a net worth of $120 billion. The family is well-known for their candy empire, but interestingly, about half of the company’s value comes from pet care holdings. Mars Inc. owns several popular pet food brands, including Pedigree, Cesar, and Royal Canin—and it expanded its pet presence further in 2017 when it acquired VCA, a company with almost 800 small animal vet hospitals across the U.S. and Canada.

The Koch family is the world’s third-richest family. Their fortune is rooted in an oil firm founded by Fred C. Koch. Following Fred’s death in 1967, the firm was inherited by his four sons—Frederick, Charles, David, and William. After a family feud, Frederick and William left the business, and Charles and David went on to build the mega industrial conglomerate known as Koch Industries.

Despite being affected by the oil crash this year, the Koch family’s wealth still sits at $109.7 billion. Before David’s passing in 2019, he and his brother Charles were heavily involved in politics—and their political efforts were the subject of much scrutiny.

Richest Families, by Sector

It’s important to note that many of these families have diversified their investments across a variety of industries. For instance, while the Koch family’s wealth is largely concentrated in the industrial sector and commodities, they also dabble in real-estate—in May 2020, they made a $200 million bet on U.S. rental homes.

That being said, it’s interesting to see where each of these families started, and which sectors have bred the highest number of ultra-wealthy families.

Here’s a breakdown of each sector and how many families on the list got started in them:

| Sector | Number of Families | Total Wealth, $B |

|---|---|---|

| Consumer Services | 8 | 514.3 |

| Industrials | 4 | 324.1 |

| Consumer Goods | 3 | 187.3 |

| Communications | 3 | 104.7 |

| Health Care | 2 | 84.5 |

| Diversified | 2 | 59.7 |

| Financials | 1 | 46.3 |

| Basical Materials | 1 | 32.9 |

| Real Estate | 1 | 30.4 |

The top sector is consumer services—8 of the 25 families are heavily involved in this sector. Walmart helped generate the most wealth out of families in this space, while luxury brands Hermès and Chanel were the source of fortune for the next two wealthiest families.

Industrial is the second largest sector, with 4 of the 25 families involved. It’s also one of the most lucrative sectors—out of the top five wealthiest families on the list, three are in industrials. The Koch family is the wealthiest family in this category, followed by the Al Saud family and the Ambani family, respectively.

Communications and consumer goods are tied for third, with 3 of the 25 families in each. The Thomsons, who founded Thomson Reuters, are the wealthiest family in communications, while the Mars family has the highest net worth in the consumer goods sector.

Resilient, but not Bulletproof

Despite a global recession, most of the world’s wealthiest families seem to be doing just fine—however, not everyone on the list has been thriving this year.

The Koch family’s fortune dropped by $15 billion from 2019 to 2020, and the current political climate in Hong Kong has had a negative impact on the Kwok family’s real estate empire.

While intergenerational wealth certainty has resilience, how much economic and social turmoil can it withstand? It’ll be interesting to see which families make the list in 2021.

YOU MAY LIKE

All of the World’s Money and Markets in One Visualization

Making Billions: The Richest People in the World

Mapped: The World’s Ultra-Rich, by Country

Mapped: The Wealthiest Person in Every U.S. State in 2020

Silver Series: Perfect Storm for Silver (Part 2 of 3)

All of the World’s Wealth in One Visualization

POLITICS

Charting America’s Debt: $27 Trillion and Counting

America’s debt recently surpassed $27 trillion. In this infographic, we peel back the layers to understand why it keeps on growing.

Published

4 days agoon

October 30, 2020

Why America’s Debt Doesn’t Stop Growing

Public sector debt has been a contentious topic for many years. While some believe that excessive government borrowing can be harmful over the long term, others have argued that it acts as a powerful tool for stimulating growth.

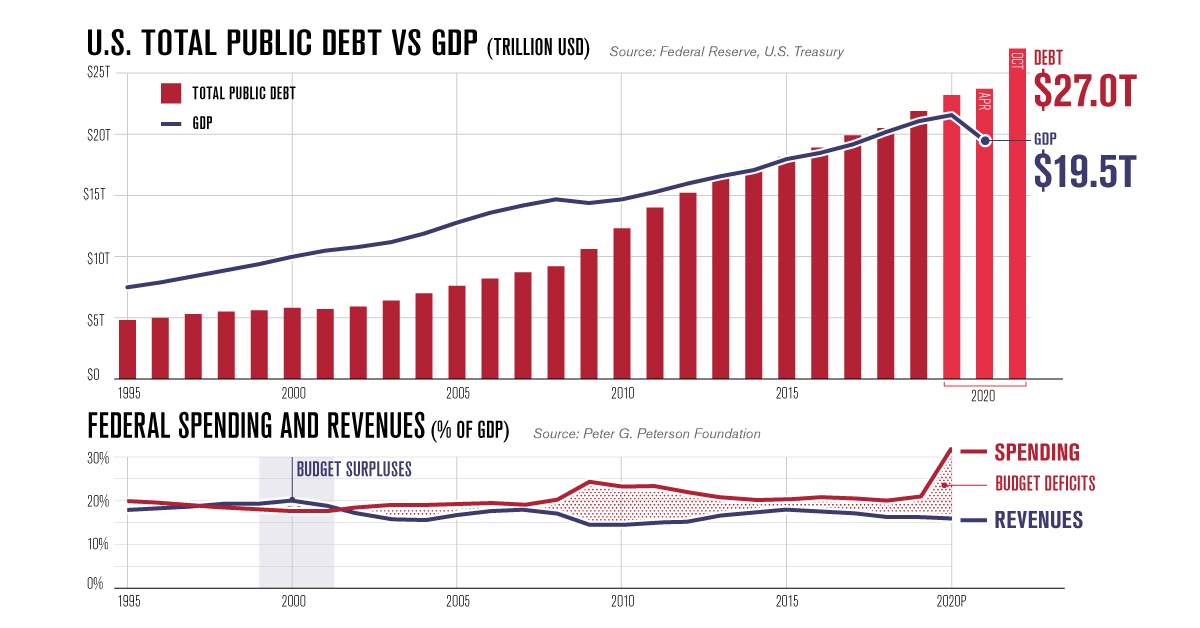

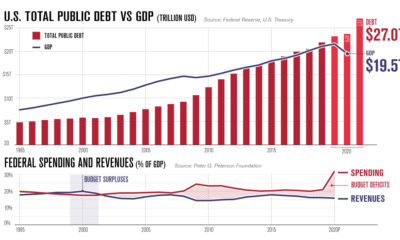

In the U.S., the latter view appears to have taken hold. Since 2008, America’s national debt has surged nearly 200%, reaching $27 trillion as of October 2020. To gain a better understanding of this ever-growing debt, this infographic takes a closer look at various U.S. budgetary datasets including the 2019 fiscal balance.

America’s Debt vs. GDP

Government debts are often represented by incredibly large numbers, making them hard to comprehend. By comparing America’s debt to its annual GDP, we can get a better grasp on the relative size of the country’s financial obligations.

| Year | Total Public Debt (USD) | GDP (USD) | Debt as % of GDP |

|---|---|---|---|

| 1994 | $4.5T | $7.1T | 63% |

| 1995 | $4.8T | $7.5T | 64% |

| 1996 | $5.0T | $7.9T | 63% |

| 1997 | $5.3T | $8.4T | 63% |

| 1998 | $5.5T | $8.9T | 62% |

| 1999 | $5.6T | $9.4T | 60% |

| 2000 | $5.8T | $10.0T | 58% |

| 2001 | $5.7T | $10.5T | 54% |

| 2002 | $5.9T | $10.8T | 55% |

| 2003 | $6.4T | $11.2T | 57% |

Source: Federal Reserve, U.S. Treasury

In this context, U.S. debt was relatively moderate between 1994 to 2007, averaging 60% of GDP over the timeframe. This took a drastic turn during the Global Financial Crisis, with debt climbing to 95% of GDP by 2012.

Since then, America’s debt has only increased in relative size. In April 2020, with the COVID-19 pandemic in full force, it reached a record 122% of GDP. This may sound troubling at first, but there are a few caveats.

For starters, there are many other advanced economies that have also surpassed the 100% debt-to-GDP milestone. The most noteworthy is Japan, where the debt-to-GDP ratio has climbed beyond 200%. Furthermore, this is not the first time America has found itself in this situation—by the end of World War II, debt-to-GDP peaked at 106% before declining to historic lows in the 1970s.

What’s Preventing the Debt From Shrinking?

Although the U.S. continuously pays off portions of its debt, the total amount it owes has increased each year since 2001. That’s because the federal government runs consistent budget deficits, meaning it spends more than it earns. During economic crises, these deficits can become incredibly large.

| Fiscal Year (Sept 30) | Budget Surplus or Deficit (USD billions) |

|---|---|

| 2000 | +$236B |

| 2001 | +$128B |

| 2002 | -$158B |

| 2003 | -$378B |

| 2004 | -$418B |

Source: Federal Reserve

In the aftermath of the Global Financial Crisis, the U.S. recorded an annual deficit of $1.4 trillion in FY2009. This was largely due to the $787 billion American Recovery and Reinvestment Act of 2009, which provided tax rebates and other economic relief.

In the economic battle against COVID-19’s impacts, the boundaries have been pushed even further. The annual deficit for FY2020 weighs in at a staggering $3.1 trillion, the largest ever. Contributing to this historic deficit was the $2 trillion CARES Act, which provided wide-ranging support to the entire U.S. economy.

Breaking Down the 2019 Fiscal Balance

Even in the years between these two economic crises, government spending still outpaced revenues. To find out more, we’ve broken down the 2019 fiscal balance into its various components.

Federal Spending

Total spending in FY2019 was roughly $4.4 trillion, and can be broken out into three components.

The first component is Mandatory Spending, which accounted for 62% of the total. Mandatory spending is required by law, and includes funding for important programs such as social security.

| Category | Amount (USD billions) | Percent of Total Federal Spending |

|---|---|---|

| Health programs | $1,121B | 25.5% |

| Social security | $1,039B | 23.6% |

| Income security | $301B | 6.8% |

| Federal civilian and military retirement | $164B | 3.7% |

| Other | $109B | 2.5% |

| Total mandatory spending | $2,735B | 62.2% |

Figures may not add to 100 due to rounding. Source: Peter G. Peterson Foundation

The largest category here was Health, with $1.1 trillion in funding for programs such as Medicare and Medicaid. Social security, which provides payments to retirees, was the second largest at $1.0 trillion.

The second component is Discretionary Spending, which accounted for 30% of the total. Discretionary spending is determined on an annual basis by Congress and the President.

| Discretionary Spending | Amount (USD) | Share of Total Federal Spending |

|---|---|---|

| Defense | $677B | 15.4% |

| Transportation | $100B | 2.3% |

| Veteran's benefits & services | $85B | 1.9% |

| Education | $72B | 1.6% |

| Health | $66B | 1.5% |

Figures may not add to 100 due to rounding. Source: Peter G. Peterson Foundation

At $677 billion, the Defense category represents over half of total discretionary spending. These funds are spread across the five branches of the U.S. military: the Army, Marine Corps, Navy, Air Force, and Space Force.

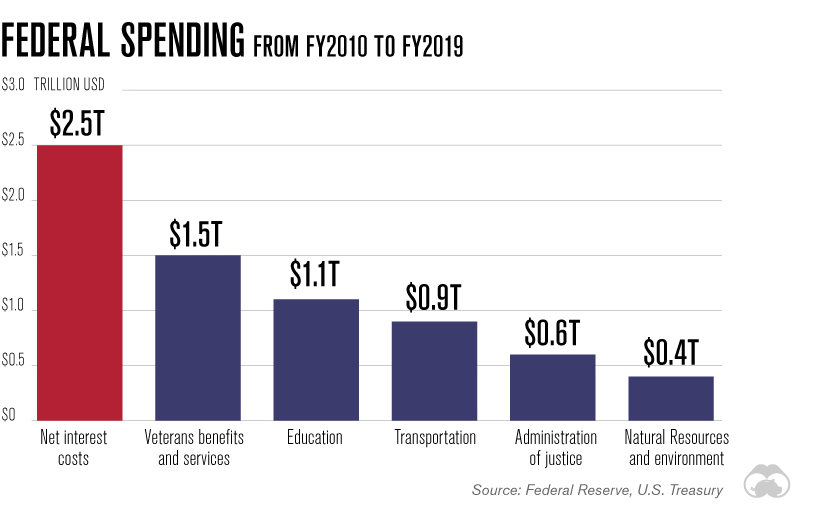

The third component of spending is the net interest costs on existing government debt. For FY2019, this was approximately $327 billion.

Federal Revenues

Revenues in FY2019 fell short of total spending, coming in at approximately $3.5 trillion. These inflows can be traced back to six categories.

| Category | Amount (USD billions) | Percent of Total Revenues |

|---|---|---|

| Individual income taxes | $1,732B | 50.0% |

| Payroll taxes | $1,247B | 36.0% |

| Corporate income taxes | $242B | 7.0% |

| Other | $104B | 3.0% |

| Excise taxes | $104B | 3.0% |

| Customs duties | $69B | 2.0% |

| Total revenues | $3,464B | 100.0% |

Figures may not add to 100 due to rounding. Source: Peter G. Peterson Foundation

Revenues overwhelmingly relied on individual income and payroll taxes, which together, accounted for 86% of the total. Corporate income taxes, on the other hand, accounted for just 7%.

Is America’s Debt a Cause for Concern?

The general consensus following the events of 2008 is that large fiscal stimulus (supported by government borrowing) was effective in speeding up the consequent recovery.

Now facing a pandemic, it’s likely that many Americans would support the idea of running large deficits to boost the economy. Surveys released in July 2020, for example, found that 82% of Americans wanted federal relief measures to be extended.

Looking beyond COVID-19, however, does reveal some warning signs. One frequent criticism of the ever-growing national debt is its associated interest costs, which could cannibalize investment in other areas. In fact, the effects of this dilemma are already becoming apparent. Over the past decade, the U.S. has spent more on interest than it has on programs such as veterans benefits and education.

With low interest rates expected for the foreseeable future, the federal government is likely to continue running its large annual deficits—at least until the effects of COVID-19 have fully subsided. Perhaps after this crisis is over, it will be time to assess the long-term sustainability of America’s rising national debt.

GOLD

Comparing Recent U.S. Presidents: New Debt Added vs. Precious Metals Production

While gold and silver coin production during U.S. presidencies has declined, public debt continues to climb to historically high levels.

Published

5 days agoon

October 29, 2020

Recent U.S. Presidents: Debt vs. Coins Added

While precious metals can’t be produced out of thin air, U.S. debt can be financed through central bank money creation. In fact, U.S. debt has skyrocketed in recent years under both Democrat and Republican administrations.

This infographic from Texas Precious Metals compares the increase in public debt to the value of gold and silver coin production during U.S. presidencies.

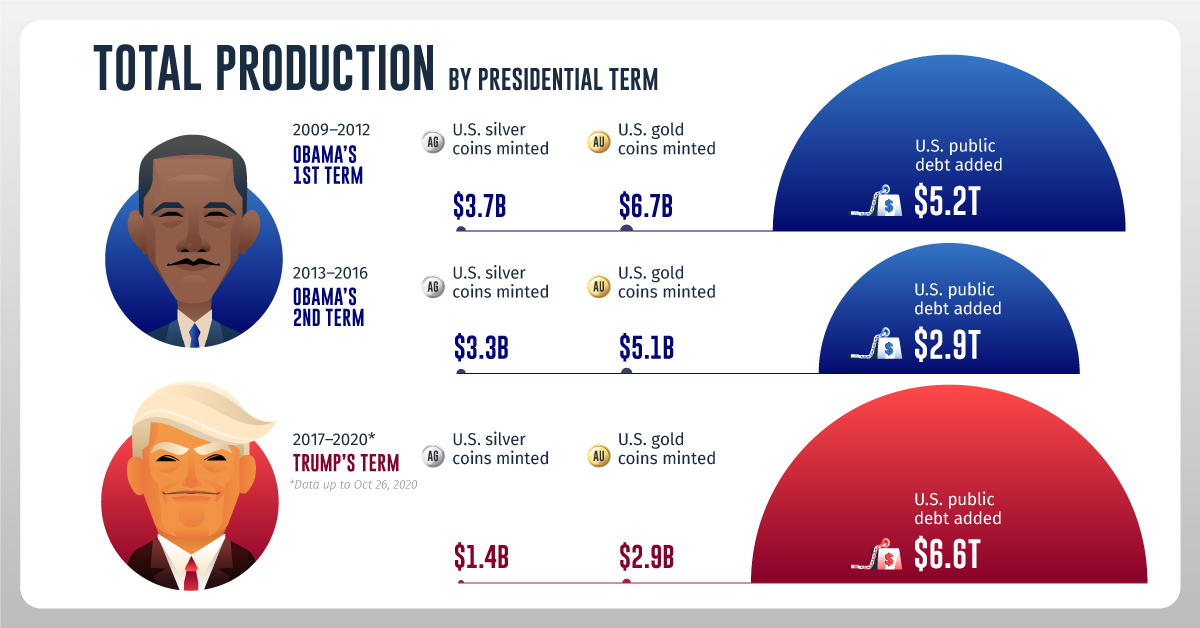

Total Production by Presidential Term

We used U.S. public debt in our calculations, a measure of debt owed to third parties such as foreign governments, corporations, and individuals, while excluding intragovernmental holdings. To derive the value of U.S. minted gold and silver coins, we multiplied new ounces produced by the average closing price of gold or silver in each respective year.

Here’s how debt growth stacks up against gold and silver coin production during recent U.S. presidencies:

| Obama's 1st term (2009-2012) | Obama's Second Term (2013-2016) | Trump's term (2017-Oct 26 2020) | |

|---|---|---|---|

| U.S. Silver Coins Minted | $3.7B | $3.3B | $1.4B |

| U.S. Gold Coins Minted | $6.7B | $5.1B | $2.9B |

| U.S. Public Debt Added | $5.2T | $2.9T | $6.6T |

Over each consecutive term, gold and silver coin production decreased. In Trump’s term so far, the value of public debt added to the system is almost 1,600 times higher than minted gold and silver coins combined.

During Obama’s first term and Trump’s term, debt saw a marked increase as the administrations provided fiscal stimulus in response to the global financial crisis and the COVID-19 pandemic. As we begin to recover from COVID-19, what might debt growth look like going forward?

U.S. Public Debt Projections

As of September 30, 2020, the end of the federal government’s fiscal year, debt had reached $21 trillion. According to estimates from the Congressional Budget Office, it’s projected to rise steadily in the future.

| 2021P | 2022P | 2023P | 2024P | 2025P | 2026P | 2027P | 2028P | 2029P | 2030P | |

|---|---|---|---|---|---|---|---|---|---|---|

| U.S. Public Debt | 21.9T | 23.3T | 24.5T | 25.7T | 26.8T | 27.9T | 29.0T | 30.4T | 31.8T | 33.5T |

| Debt-to-GDP ratio | 104.4% | 105.6% | 106.7% | 107.1% | 107.2% | 106.7% | 106.3% | 106.8% | 107.4% | 108.9% |

By 2030, debt will have risen by over $12 trillion from 2020 levels and the debt-to-GDP ratio will be almost 109%.

It’s worth noting that debt will likely grow substantially regardless of who is elected in the 2020 U.S. election. Central estimates by the Committee for a Responsible Federal Budget show debt rising by $5 trillion under Trump and $5.6 trillion under Biden through 2030. These estimates exclude any COVID-19 relief policies.

What Could This Mean for Investors?

As the U.S. Federal Reserve creates more money to finance rising government debt, inflation could eventually be pushed higher. This could affect the value of the U.S. dollar.

On the flip side, gold and silver have a limited supply and coin production has decreased over the last three presidential terms. Both can act as an inflation hedge, while playing a role in wealth preservation.

POPULAR

AGRICULTURE1 week ago

AGRICULTURE1 week agoThe Economics of Coffee in One Chart

POLITICS4 days ago

POLITICS4 days agoCharting America’s Debt: $27 Trillion and Counting

TECHNOLOGY2 months ago

TECHNOLOGY2 months agoHere’s What Happens Every Minute on the Internet in 2020

MISC4 days ago

MISC4 days agoThe 50 Highest Cities in the World

GOLD5 days ago

GOLD5 days agoComparing Recent U.S. Presidents: New Debt Added vs. Precious Metals Production

TECHNOLOGY2 weeks ago

TECHNOLOGY2 weeks agoMapped: The Top Female Founder in Each Country

AGRICULTURE6 days ago

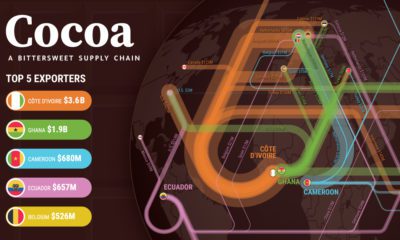

AGRICULTURE6 days agoCocoa: A Bittersweet Supply Chain

MISC1 month ago

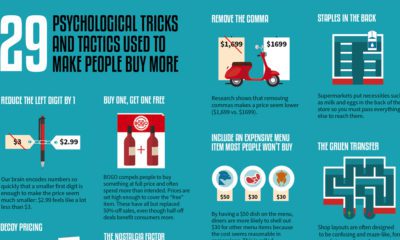

MISC1 month ago29 Psychological Tricks To Make You Buy More

No comments:

Post a Comment

Ameya jaywant narvekar